4Q2025 Quarterly Insights Newsletter

U.S. Equities

Main Points

-

Equities outperformed other asset classes in Q4, led by international stocks and large-cap U.S. equities.

-

Leadership was highly dispersed, with large caps and momentum outperforming while mid-caps and dividend strategies lagged.

-

With Fed easing underway, equities enter 2026 supported by policy tailwinds.

U.S. Sectors

Main Points

-

Sector leadership broadened in Q4 as Growth cooled and cyclical Value sectors gained traction.

-

Industries rotated sharply, with pharmaceuticals and metals rebounding while mega-cap technology momentum stalled.

-

Entering 2026, balanced leadership is likely, with cyclical sectors benefiting from steady growth and easing policy.

U.S. Economy & Fixed Income

Main Points

-

U.S. growth remained resilient despite manufacturing weakness, supported by strong consumers and exports.

-

Inflation stayed above target but eased late quarter, calming fears of restrictive policy.

-

Falling yields and Fed easing supported bonds, with gradual cuts expected into 2026.

International Equities

Main Points

-

Global markets ended 2025 mixed, with steady growth and low recession risk.

-

Emerging markets and Europe outperformed, while the U.S. and U.K. lagged.

-

Key factors for 2026 include interest rates, currencies, inflation, and geopolitics.

Q2 Asset Class Benchmark Returns

Q2 S&P 500 Sector Returns

Equities capped off a strong 2025 with continued leadership over other asset classes in Q4. Stocks again outperformed bonds, cash, and commodities, supported by easing financial conditions and a weakening U.S. dollar. International equities stood out, with developed markets edging out emerging markets during the quarter, while both outpaced U.S. benchmarks. Large-cap U.S. stocks led domestically, even as the tech-heavy Nasdaq cooled late in the year. Style performance was mixed: Value rebounded relative to Growth in Q4, though results varied meaningfully across Russell and S&P indices.

Within U.S. equities, dispersion was a defining theme. Large caps outperformed small caps, while mid-caps lagged both, which is an uncommon outcome historically. Value beat Growth across all Russell cap tiers during the quarter, most notably in mid-caps, even as Growth retained a narrow edge for the full year in large caps.

Factor performance echoed this divergence. Momentum and select Growth factors delivered strong returns, while Quality and dividend-oriented strategies struggled. Macro-sensitive factors produced inconsistent results, highlighting a market driven more by positioning and sentiment than uniform economic signals.

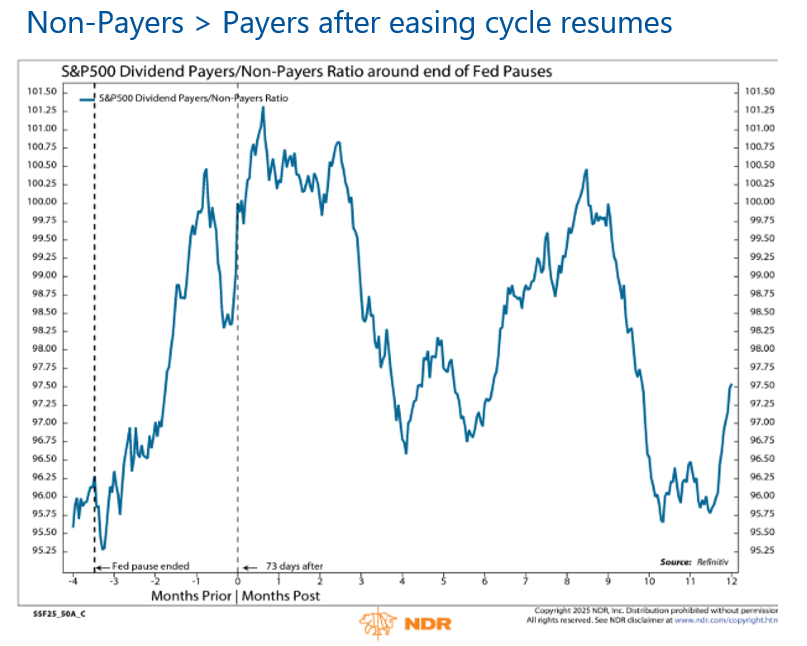

After resuming rate cuts in September, the Fed enters 2026 with markets expecting further easing at a slower pace. Historically, equities have responded favorably following the restart of easing cycles, suggesting a constructive backdrop for Q1. Higher-beta, dividend non-payers have tended to lead early in easing phases, particularly amid a steepening yield curve and resilient growth expectations.

However, dividend payers and high yielders have historically strengthened later in the cycle, potentially setting the stage for a gradual leadership rotation as 2026 progresses (chart below).

Source: Ned Davis Research (NDR)

Sector performance in Q4 2025 reflected a clear shift toward balance after years of Growth dominance. Most sectors posted gains during the quarter, with the exception of Utilities, Real Estate, and Consumer Staples. Health Care emerged as the top-performing sector, supported by pharmaceutical companies reaching pricing agreements with the Trump administration in exchange for tariff relief. While Growth sectors lagged late in the year, leadership broadened meaningfully compared with earlier phases of the bull market, marking a notable transition in market dynamics.

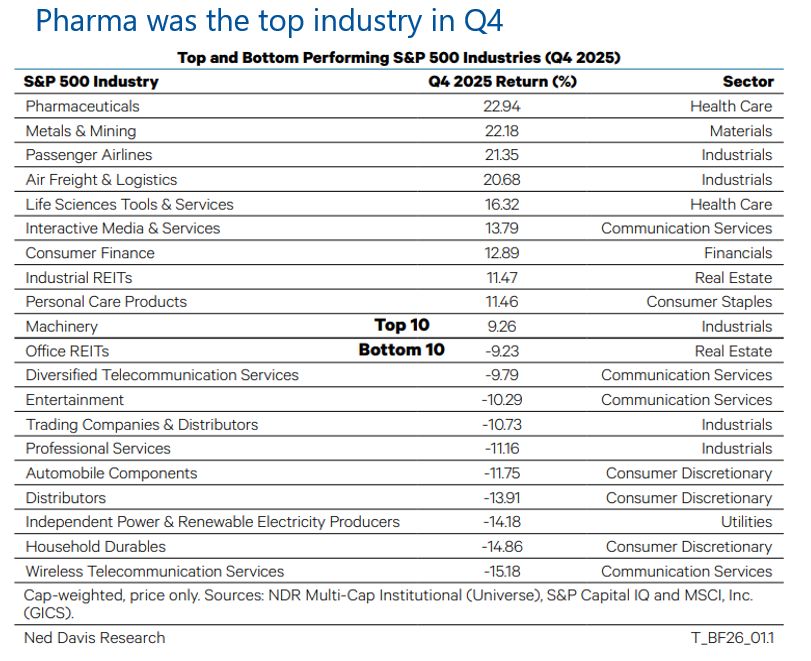

Industry leadership flipped in Q4, as several long-standing laggards rebounded sharply. Pharmaceuticals led all industries during the quarter, while Metals & Mining continued to benefit from surging metal prices (table right). December highlighted the evolving rotation: economically sensitive Value sectors such as Financials, Materials, Industrials, and Energy outperformed, supported by resilient growth and a favorable “Goldilocks” policy message from the Fed. Defensive Value sectors, however, struggled, underscoring that risk appetite remained intact despite reduced enthusiasm for Growth. Mega-cap technology stocks stalled late in the year, with broader market gains driven increasingly by non–mega-cap stocks.

Looking ahead to Q1 2026, the sector backdrop remains constructive but more selective.

Growth continues to dominate on a multi-year basis, with Technology and Communication Services delivering exceptional longer-term returns, though near-term leadership may remain more evenly distributed. A sustained Growth resurgence will likely depend on renewed confidence in AI-driven earnings. Meanwhile, cyclical Value sectors appear positioned to benefit if economic momentum holds and Fed easing continues, while Real Estate remains challenged by structural and rate-sensitive headwinds.

Source: Ned Davis Research (NDR)

Economic data in Q4 2025 painted a mixed but ultimately resilient picture for the U.S. economy. Manufacturing remained a clear weak spot, with the ISM Manufacturing PMI falling further into contraction in December, signaling widespread softness in factory activity. In contrast, overall growth surprised to the upside. Real GDP surged at a 4.3% annualized pace in Q3, driven primarily by strong consumer spending and net exports, while government spending also contributed. On a year-over-year basis, growth held at a solid 2.3%, though data quality was clouded by disruptions from the prolonged government shutdown.

Stronger growth coincided with firmer inflation readings during the quarter. The core GDP deflator accelerated sharply, while core PCE inflation also moved higher, remaining above the Fed’s 2% target. However, later consumer inflation data provided some reassurance.

November CPI and core CPI both surprised to the downside, easing investor concerns about persistent inflation pressures. Housing data pointed to stabilization rather than renewed acceleration, with home prices rising modestly month over month but showing subdued annual growth, particularly outside select coastal markets.

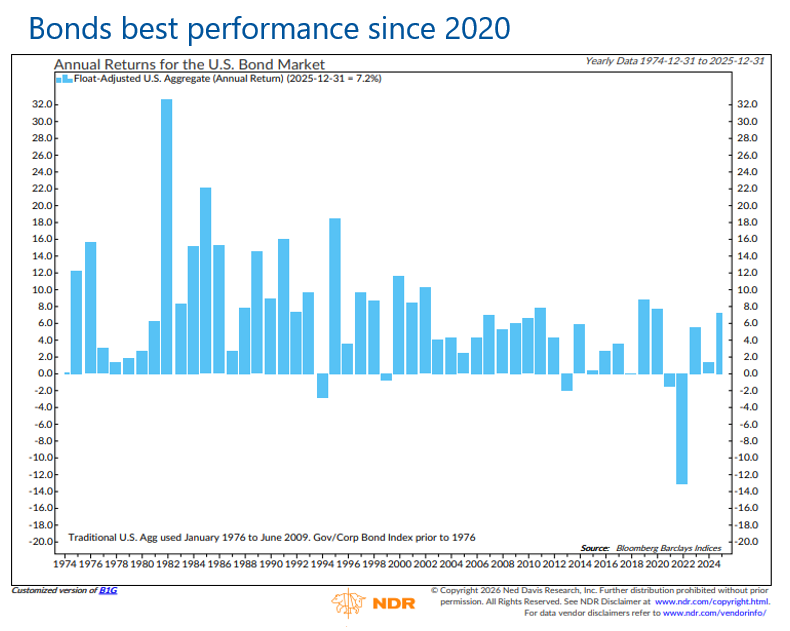

Fixed income delivered its strongest annual performance in five years, supported by declining Treasury yields and the Fed’s clear policy pivot (chart below). The 10-year Treasury yield fell meaningfully from early-year highs, despite ongoing fiscal deficit concerns and resilient economic growth.

The Fed resumed rate cuts in September, delivering three reductions by year-end as labor market risks rose. Looking into Q1 2026, markets expect continued, though slower, easing. While inflation is likely to remain above target near term, fading tariff effects later in 2026 may allow further cuts, supporting bond returns amid moderating growth.

Source: Ned Davis Research (NDR)

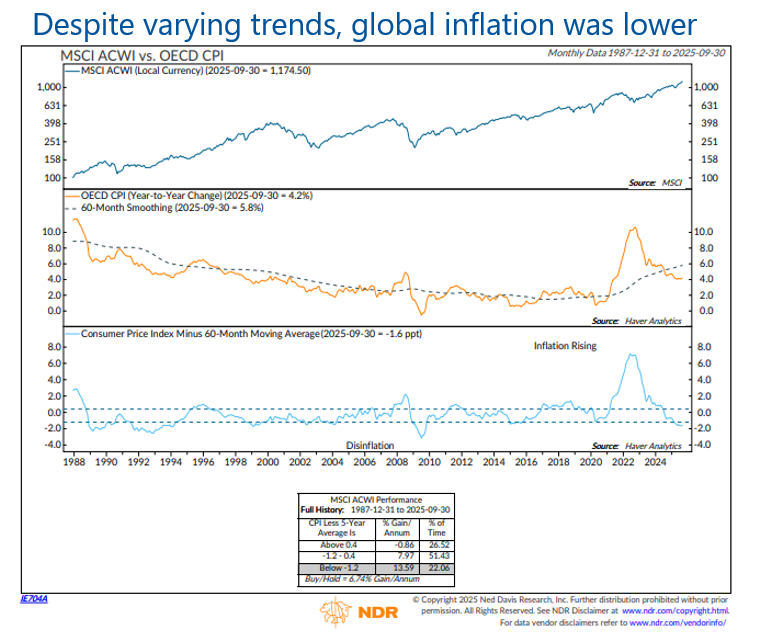

Global equity markets closed the fourth quarter of 2025 with a mixed but generally constructive backdrop. Most major economies continued to expand, avoiding recession despite persistent macro crosscurrents. The U.S., eurozone, Japan, and India maintained steady growth, while momentum softened modestly in the U.K., China, and Brazil. Inflation appears to be either steady or moving lower in most of the world’s major economies (chart right). However, in the U.S., inflation is likely to remain above the Fed’s target well into next year. Overall, fiscal and monetary policy conditions remained supportive, helping underpin risk assets late in Q4.

International equities showed notable regional divergence. Emerging markets benefited from improving relative growth dynamics, easing inflation, and supportive currency trends as the U.S. dollar weakened. Europe’s recovery gained traction and continued to outperform as growth broadened beyond the core economies, supported by accommodative financial conditions and improving real incomes.

In contrast, U.S. equities lagged international peers amid narrowing market breadth and valuation concerns, while U.K. equities were constrained by slower domestic growth and sector concentration.

China’s economy met its annual growth objectives, supported by manufacturing strength and exports.

Looking into Q1 2026, the key variables to monitor will be interest rate trends, inflation expectations, currency movements, and global trade developments. Rising real yields or renewed dollar strength could challenge risk assets, while stable rates, easing inflation, and policy continuity would support international equity performance early in the year. Geopolitical developments and shifts in fiscal policy, particularly in Europe and the U.S., may also play a meaningful role in shaping investor sentiment and regional market leadership as the new year begins.

Source: Ned Davis Research (NDR)