How Our Investment Management can Make a Difference

“Stonehearth Capital Management have been managing our retirement portfolio for over 20 years. David Juliano is our advisor and we put all our trust in him. He always explains our investments in terms that we understand and is very receptive to our questions or concerns.”

Disclosure: This Google review is from an existing client of Stonehearth Capital Management. No existing client was compensated, either with cash or non-cash benefits, in exchange for their statement. Reviews reflect individual experiences and may not be representative of all clients. No material conflicts of interest are known to exist in connection with these testimonials. Read more reviews.

Keeping Our Clients Informed - Trade Notification

Most Recent Quarterly CIO Corner

A Disciplined, Diversified Approach Built for Real Life

At Stonehearth Capital Management, we believe in building portfolios that are as thoughtful and resilient as the families they’re built for. Our investment philosophy centers on diversification, adaptability, and a deep respect for risk. We don’t chase markets or react emotionally to headlines. We use data, structure, and experience to guide every decision.

We believe that peace of mind comes from having a plan you can trust—and a team that proactively adapts as conditions change.

Diversification: The Foundation of a Resilient Portfolio

When building a house, the foundation takes the longest and is the most important part to get right. Once it’s in place, the rest of the structure goes up quickly—and with confidence.

That’s how we view diversification. It may feel slow or subtle at first, but it’s what allows your portfolio to weather uncertainty and support everything you’re working toward. One asset class at a time with hedging as a goal.

A strong portfolio, like a strong home, starts with a foundation you can trust.

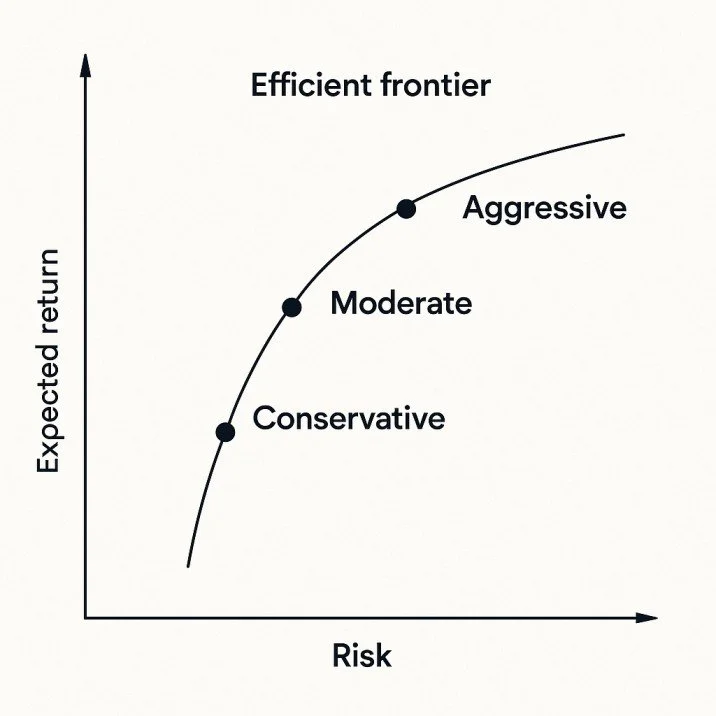

Custom Designs for Different Risk Tolerances

Not every client wants the same kind of home — and not every investor wants the same level of risk.

We offer three core portfolio profiles, each tailored to align with your financial goals and risk tolerance:

Conservative: Prioritizes capital preservation and steady income, suitable for those seeking stability.

Moderate: Balances growth potential with risk management, ideal for investors looking for a middle ground.

Aggressive: Focuses on higher growth opportunities, appropriate for those comfortable with increased market volatility."

Each is built with the same care and structural integrity — just tailored to different blueprints.

For illustrative purposes

Disclosure

Diversification does not guarantee protection against market loss or eliminate the possibility of underperformance. While a diversified portfolio is designed to spread risk across asset classes it may still be adversely affected by systematic market downturns or correlated shocks. Our ‘Conservative,’ ‘Moderate,’ and ‘Aggressive’ portfolio profiles are tailored to different tolerance levels—but none can ensure a particular level of return or fully mitigate volatility. Past performance is not indicative of future results. Any forward‑looking statements regarding portfolio performance, expected resilience, or risk-adjusted outcomes are subject to inherent uncertainty and may differ materially from actual results. All investments involve risk, including potential loss of principal. Market volatility, changing interest rates, inflation, regulatory shifts, geopolitical events, and economic downturns can materially impact the outcomes of even well-diversified strategies. Allocations and designations within your portfolio are customized based on your stated risk tolerance and goals. However, customization does not equate to guarantee—market forces and changing conditions may affect outcomes in unpredictable ways. The information provided on this website is for educational purposes only and does not constitute a recommendation, offer, or solicitation to buy or sell any investment product. Clients should make their own assessments or consult their professional advisors regarding any investment decisions.

Ongoing Maintenance: Keeping Your Plan on Track

Building is just the beginning — what matters is how you maintain it.

We don’t just set your portfolio and walk away. We act as your general contractor for long-term achievement, aiming to provide:

Rebalancing – Adjusting your investments as markets shift, so your plan stays aligned

Tax-loss harvesting – Strategically capturing losses to offset gains and reduce tax exposure

Product selection – Choosing robust investments that fit your design

Risk-based equity adjustments – Actively managing how much market exposure you have, based on real-time risk factors

You may not see it happening every day, but like any well-run home, the care and oversight never stop.

The Result: A Home That Supports Your Life

With a strong foundation, a smart design, and ongoing attention, your portfolio becomes more than numbers on a screen — it becomes a financial home you can count on through every life transition.

Frequently Asked Questions

-

A: We are product agnostic. While most of our clients' assets are held in ETFs and mutual funds, we also use individual stocks and bonds when they’re a better fit for a client’s specific needs and goals.

-

A: We make fundamental and risk-based trades in response to changes in market conditions and data. To maintain alignment with each client’s target allocation, we also rebalance portfolios at least once per quarter.

-

A: No. We take the time to evaluate your current holdings and weigh the pros and cons of making any changes. We only move forward with a plan once you’re comfortable. In many cases, we recommend keeping legacy positions—especially when tax consequences or long-standing loyalty to a company are important considerations.

-

A: All portfolios are managed in-house by Stonehearth Capital Management’s investment committee, which brings decades of experience. This hands-on approach allows us to make informed, tailored decisions for our clients—without relying on third-party managers.

Disclosure

Stonehearth Capital Management, LLC is a Registered Investment Advisor. Registration does not imply a certain level of skill or training. Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future. This website does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact Stonehearth Capital Management, or consult with the professional advisor of their choosing.