Increasing Emerging Markets Equity Exposure - 10/31/25

Portfolio Adjustments

-

Diversified Portfolios

Current Stock Exposure: 94.5%

Benchmark Stock Exposure: 85%

Sell: -2.5% GOVT: iShares U.S. Treasury Bond ETF.

Buy: +2.5% AVEM: Avantis Emerging Market Equity ETF.

CarbonLITE Portfolios

Current Stock Exposure: 94.5%

Benchmark Stock Exposure: 85%

Sell: -2.5% GOVT: iShares U.S. Treasury Bond ETF.

Buy: +2.5% CVMIX: Calvert Emerging Market Equity Fund.

ETF-Only Portfolios

Current Stock Exposure: 94.5%

Benchmark Stock Exposure: 85%

Sell: -2.5% GOVT: iShares U.S. Treasury Bond ETF.

Buy: +2.5% AVEM: Avantis Emerging Market Equity ETF.

-

Diversified Portfolios

Current Stock Exposure: 64%

Benchmark Stock Exposure: 60%

Sell: -2.5% GIBIX: Guggenheim Total Return Bond Fund.

Buy: +2.5% AVEM: Avantis Emerging Market Equity ETF.

CarbonLITE Portfolios

Current Stock Exposure: 64%

Benchmark Stock Exposure: 60%

Sell: -2.5% GIBIX: Guggenheim Total Return Bond Fund.

Buy: +2.5% CVMIX: Calvert Emerging Market Equity Fund.

ETF-Only Portfolios

Current Stock Exposure: 64%

Benchmark Stock Exposure: 60%

Sell: -2.5% JCPB: J.P. Morgan Core Plus Bond ETF.

Buy: +2.5% AVEM: Avantis Emerging Market Equity ETF.

-

Diversified Portfolios

Current Stock Exposure: 29%

Benchmark Stock Exposure: 30%

No trades.

CarbonLITE Portfolios

Current Stock Exposure: 29%

Benchmark Stock Exposure: 30%

No trades.

ETF-Only Portfolios

Current Stock Exposure: 29%

Benchmark Stock Exposure: 30%

No trades.

We wanted to share a brief update on a recent portfolio adjustment and the rationale behind it.

As part of our ongoing effort to keep your portfolio aligned with the data, we have reduced our exposure to bonds and increased our allocation to emerging market equities.

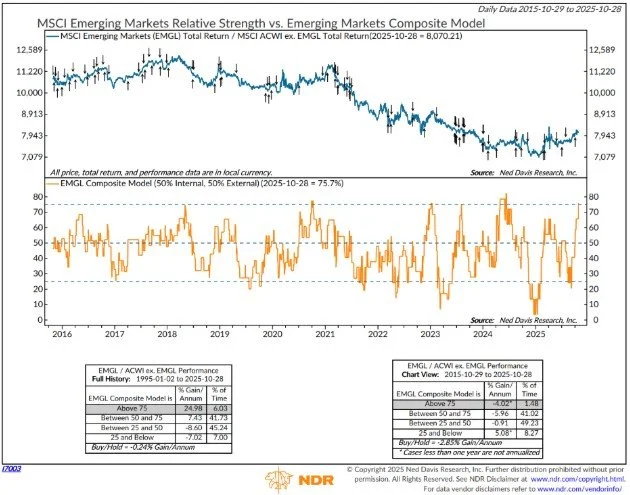

As you can see from the chart below from Ned Davis Research, the technical and foundational data based on the weight of evidence continues to improve for Emerging Market Equities. The current score of 75.7% has historically been a favorable level for adding to Emerging Market Equities.

Source: www.NDR.com

With our overall risk modeling still indicating a favorable environment for tilting into risk, we funded the purchase by reducing our over-weight to the more defensive fixed income asset class.

We continue to monitor the data and will remain nimble in adjusting allocations as risks and opportunities evolve. As always, our goal is to ensure your portfolio remains aligned with your long-term objectives and risk tolerance.

You’ll receive a trade confirmation from Charles Schwab reflecting these transactions. If you'd like to walk through these trades or discuss the positioning in more detail, we are happy to schedule a time to talk.

We're here to help you stay grounded, informed, and positioned for the long term, even when the market isn’t making it easy.

Warm Regards,

SCM Investment Committee